Motivation, inspiration, information... Get-rich-quick because life is too short to get rich slow.

Showing posts with label how to. Show all posts

Showing posts with label how to. Show all posts

Monday, May 23, 2016

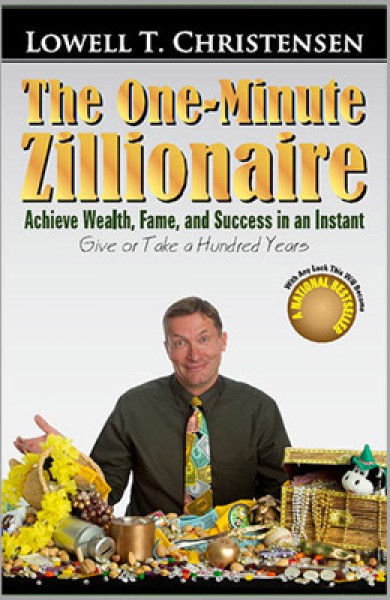

The One-Minute Zillionaire

Monday, May 9, 2016

Friday, May 6, 2016

Thursday, May 5, 2016

Friday, April 29, 2016

7 Reasons Why a Drug Dealer is a Better Entrepreneur Than You

7 Reasons Why a Drug Dealer is a Better Entrepreneur Than You

Sebastian Dillon - May 13, 2014

Drug Dealers have usually always been looked-down upon within society, but if you take a closer look at some of today’s most successful entrepreneurs, they started out as drug dealers. Jay Z, P. Diddy, and 50 Cent all used drug dealing as a means of survival and reaching success.

Some studies have also shown that successful entrepreneurs and drug dealers are actually cut from the same cloth. In a paper titled “Drug dealing and legitimate self-employment,” economist Rob Fairlie notes a statistical relationships between being a teen drug dealer and being an entrepreneur as an adult. Fairlie argues that the same characteristics that lead people to become entrepreneurs as adults also lead them to be drug dealers as teenagers.

With that being said, here are seven reasons why a drug dealer is a better entrepreneur than you are.

They face way tougher competitors.

In the business world, a competitor can try to mess with you by offering lower prices or copying you. In the drug world, if you do things like accidentally selling in someone else’s corner, you potentially face pain and even death for you and your whole family. Dealing with situations like this while having to make sure your product is still good and your operations are running smoothly is something no startup entrepreneur will ever have to face. Take this Quora user’s account of his time as a drug dealer:

“I was threatened with knives. Once a guy with four spiked rings on his hand was a second from punching me in the face. I’ve had guns pointed at my head.”

As a startup founder, I think it’s safe to say that you’ll never have a gun pointed at your head, not literally at least.

They know the true meaning of risk-taking.

Say you build a startup, what is the WORST thing that can happen to you? Losing money? Bankruptcy? Getting a bad reputation? In the drug world, you’re not only constantly facing death, but you also risk getting caught and jailed. For someone that goes into drug dealing with this reality in mind, you know you are going absolutely all-in with hopes of seeing success.

Many millennial startup founders today have a safety-net, whether it’s their parents or a full-time job to handle. It’s rare to see something that is truly risking everything in order to succeed.

They’re laser-focused on the bottom-line.

Drug dealers have only one goal: to make Money. This is the core of why businesses succeed and survive.

Because of all the stories of startups getting acquired for billions of dollars with no revenue, entrepreneurs everywhere think they than start a company without thinking about how to make money at all. In a past interview with serial entrepreneur Scott Gerber, he explained:

“…I need more than enough people that are 18-20-somethings that simply say, “I’ll figure out the money equation later.” And I think that’s the stupidest way to think about business because at the end of the day, less than probably 2% of people that start a business are ever going to see a dollar of real investment money.”

Having passion is obviously great, but you will need to focus on the bottom-line longterm if you want your business to thrive.

They know that it’s all about the product.

People may buy from you the first time, but if your drugs suck or they feel ripped off, you won’t get repeat customers unless you’re completely scraping at the bottom of the barrel. Every successful business starts with a quality product so you need to spend a ton of time perfecting it. In the words of angel investor Jason Calacanis, “product speaks.” So when you’ve actually produced a top-notch product, it will market itself.

They know how to manage people.

Notorious drug kingpin Freeway Rick Ross was known for managing over 1000 drug dealers and was making $2 million a day back in his prime. How did he do it? He genuinely cared about people and always looked for ways to keep his subordinates happy.

“…when my guys would go to prison, I would try to go out and [try] to get the best attorney I could. I would try to bail them out of jail immediately, and do all the things that they needed to put their life back on track, because that’s the way I would’ve wanted for somebody to do for me.”

Being able to keep your team in check at all times while making sure they like working with you is a concept that many startup entrepreneurs today have yet to grasp. Take Clinkle founder Lucas Duplan for instance, he raised $30 million for his startup and is known for treating his employees like shit. One of his former employees goes as far as saying that working for him “was like going through an abusive relationship.”

They can sell and know customer service.

Let’s face it, as underground as the drug dealing business is, there are tons are people doing it. What is going to separate you from everyone else? Take some notes from Freeway Rick Ross:

“People buy from people they like, so in the drug business people came and bought from me because not only did I have good drugs, but they also like me. They wanted to see me do good, and when people want to see you do good, they’re going to help you. They would rather bring their Money to you because you treat them like somebody than go to this other guy who’s going to talk to him bad, cuss him out, slap them when they short. You know, my customers come to me and they were short, I would give them some on credit. And I think people appreciated that.”

This is customer service 101. Keeping your customers happy is not an easy thing to do, and I see many new businesses struggle with this. This is the reason Zappos is so successful- they make sure everything they do starts with great customer service.

They’re creative marketers.

When building a startup, it can be tough to budget out Money for paid advertising. When it comes to drug dealing, you don’t have the luxury of publicly promoting it even if you had the Money. So they have to resort to being more creative like researching and choosing the right places to sell, as well as networking with the right people to gain more customers. Lead generation is a huge challenge that many new startups have and I personally find it amazing how clueless entrepreneurs can be when it comes to it.

Read more at: http://nextshark.com/7-reasons-why-a-drug-dealer-is-a-better-entrepreneur-than-you/#rmns

Written by Sebastian Dillion

Source:

http://nextshark.com/7-reasons-why-a-drug-dealer-is-a-better-entrepreneur-than-you/

Related links: https://www.vice.com/read/the-lies-drug-dealers-tell-people-to-keep-their-careers-secret

Labels:

drug dealer,

entrepreneur,

hip hop,

how to,

kingpin

Thursday, January 7, 2016

The usefulness of Play Money

As I always say "Un chirurgien doit se pratiquer sur des cadavres avant d'opérer des vivants." Which could be translated as "A surgeon must practice on corpses before operate on living people."

This is entirely true and that describe my view on Poker playing. If you needs several hours, months, and years of formation to be able to exercises a craft or a profession. Why it should be otherwise for Online Poker? Poker playing is all about the Money! The level of knowledge of the average poker player is higher than ever. Regular online poker players certainly have hundreds, if not thousands, of hours of play as experience. How can you survive if you jump head first into the shark infested sea of online poker? How can you succeed without losing your shirt?

Since the level of Poker playing is so high right now. I feel that I need to practice, study, and specialize to be any good and profitable at Poker.

My game of choice, as you may know reading this blog, is Heads-Up Fixed Limit Texas Hold' Em Poker. Right now I'm playing (practicing) at Pokerstars (the best place ever to play any kind of poker). I climb the level How can you expect to be lucrative at the lowest money tables if you can't rules the fake money tables?

I'm currently on a 1,000,000 Play Money Challenge.

I started with the usual 1000 chips given by PokerStars and I will climb my way step by step to the top.

- Only playing Heads-Up Limit Hold' Em on Pokerstars.

- Starting from the buttom of the ladder at 10/20.

- Playing each game with 20 Big Blinds to the finish.

- Taking a break after losing a game/stack.

- Needing 400 Big Blinds to play at a level.

- Return to the preceding level when I'm not satisfied of my playing.

- Writing everything on paper (stack, number of hours and hands played, level, comments & impressions of the days) after each day. With weekly, monthly, and yearly total.

Discipline, strict money/bankroll management and a lot of hours of practice and hands played.

Here is the required chip bankroll needed to play at each level.

- 10/20 = 1000 chips

- 25/50 = 20,000 chips

- 50/100 = 40,000 chips

- 100/200 = 80,000 chips

- 250/500 = 200,000 chips

- 500/1000 = 400,000 chips

- 1000/2000 = 800,000 chips

Here above is my can't miss plan to my Heads-Up Limit Hold' Em domination.

What's yours? Do you have a plan?

Deposit $20 and get $20 free to play with at PokerStars

Labels:

fake,

free,

how to,

learn,

learning,

money,

online poker,

play,

play for free,

play money,

poker,

PokerStars,

practice

Wednesday, December 16, 2015

Swagg Man sur Comment être Riche

Swagg Man a republié un article sur "Comment être Riche"

Il devrait en écrire un sur comment avoir l'air riche.

VOILA UN ECONOMISTE QUI A TOUT COMPRIS heart emoticon : www.atlantico.fr :

comment devient-on riche en France en partant de rien?

Condition n° 1 :

pour devenir riche, il faut ... s’intéresser à son argent

Une évidence me direz-vous ... ? ...Pas si sûr ! Les personnes qui considèrent l’argent autrement que comme une résultante de leur activité professionnelle, qui regardent leur situation financière comme un domaine à part entière de leur vie, sont rares.

pour devenir riche, il faut ... s’intéresser à son argent

Une évidence me direz-vous ... ? ...Pas si sûr ! Les personnes qui considèrent l’argent autrement que comme une résultante de leur activité professionnelle, qui regardent leur situation financière comme un domaine à part entière de leur vie, sont rares.

Or si votre richesse (absolue ou relative) peut effectivement provenir de votre activité professionnelle, elle peut tout aussi bien découler d’un loisir ou d’une passion (la cuisine, la photo, internet ...), de votre carnet d’adresses (en étant rémunéré en tant qu’intermédiaire) ou de l’intérêt que vous porterez aux investissements financiers ou à l’immobilier.

Pour les nombreuses options financières à votre disposition, il vous faudra d’abord apprendre à dissocier le travail et l’argent ; apprendre à vous intéresser à vos finances et leur consacrer du temps et de l’attention. Impossible de devenir riche si "l’argent ne vous intéresse pas" !

Condition n° 2 :

affirmer son envie

Au fond, tout le monde a envie d’être riche. Par héritage, par mariage ou en jouant au loto. Sans rien faire et surtout sans le dire ! Parce que vouloir gagner de l’argent et "devenir riche" est mal vu (depuis quand "riche" est-il devenu un gros mot ?) et forcément hasardeux (pas de succès garanti), nombreux sont ceux qui se contenteront d’en rêver et danseront en permanence un grand écart entre le discours ambiant (haro sur les riches !) et leur désir secret.

Le premier pas pour devenir riche : arrêter d’en vouloir aux riches ; arrêter de prétendre ne pas vouloir plus d’argent ; accepter des ambitions pour lesquelles l’argent sera le carburant ; accepter l’envie d’avoir ou de faire plus … et commencer à agir dans ce sens.

Sans nécessairement le proclamer haut et fort (un peu risqué par les temps qui courent) ... se l’avouer à soi-même suffira probablement - dans un premier temps !

affirmer son envie

Au fond, tout le monde a envie d’être riche. Par héritage, par mariage ou en jouant au loto. Sans rien faire et surtout sans le dire ! Parce que vouloir gagner de l’argent et "devenir riche" est mal vu (depuis quand "riche" est-il devenu un gros mot ?) et forcément hasardeux (pas de succès garanti), nombreux sont ceux qui se contenteront d’en rêver et danseront en permanence un grand écart entre le discours ambiant (haro sur les riches !) et leur désir secret.

Le premier pas pour devenir riche : arrêter d’en vouloir aux riches ; arrêter de prétendre ne pas vouloir plus d’argent ; accepter des ambitions pour lesquelles l’argent sera le carburant ; accepter l’envie d’avoir ou de faire plus … et commencer à agir dans ce sens.

Sans nécessairement le proclamer haut et fort (un peu risqué par les temps qui courent) ... se l’avouer à soi-même suffira probablement - dans un premier temps !

Condition n° 3 :

Penser autrement

Peut-on devenir riche en pensant et en faisant comme tout le monde ? Définitivement non ... ! C’est LA condition essentielle pour espérer devenir riche un jour : penser autrement ; voir ce que les autres ne voient pas (le palais sous le tas de pierres) et agir différemment (acheter quand les autres vendent ... épargner quand tout nous incite à consommer ... investir dans une formation plutôt que dans une nouvelle voiture).

Penser autrement

Peut-on devenir riche en pensant et en faisant comme tout le monde ? Définitivement non ... ! C’est LA condition essentielle pour espérer devenir riche un jour : penser autrement ; voir ce que les autres ne voient pas (le palais sous le tas de pierres) et agir différemment (acheter quand les autres vendent ... épargner quand tout nous incite à consommer ... investir dans une formation plutôt que dans une nouvelle voiture).

C’est aussi la raison pour laquelle il y a si peu de vrais candidats à la richesse : non pas que l’imagination et la créativité fassent défaut à la plupart d’entre nous, mais parce que penser et agir différemment signifient quitter la majorité pour une minorité, passer parfois pour un peu fou (ou folle) - et jouer les explorateurs sur des sentiers pas vraiment balisés.

Pas très rassurant et souvent dissuasif.

Pourtant, la richesse est au prix de l’indépendance et de la différence.

|

| JE DÉPENSE MINIMUM 200.000€ PAR MOIS CHEZ ROLEX . JE SUIS MILLIONNAIRE TU AURAIS FAIT PAREILLE MAIS TU NI LEVIDENCE... © 2014 pheed.com/TheSwaggManTV |

Condition n° 4 :

investir et lâcher prise

On ne devient pas riche sans investir. De l’argent ou du temps. En matière de richesse, avoir de l’argent de côté est forcément un plus.

Mais notre argent n’est pas la seule ressource à notre disposition. Il en existe d’autres, qui le remplacent souvent avantageusement ... Pour n’en citer que quelques-unes : l’argent des autres ; notre temps ... et la plus importante d’entre toutes : la confiance.

investir et lâcher prise

On ne devient pas riche sans investir. De l’argent ou du temps. En matière de richesse, avoir de l’argent de côté est forcément un plus.

Mais notre argent n’est pas la seule ressource à notre disposition. Il en existe d’autres, qui le remplacent souvent avantageusement ... Pour n’en citer que quelques-unes : l’argent des autres ; notre temps ... et la plus importante d’entre toutes : la confiance.

Pourquoi prête-t-on davantage aux riches qu’aux moins riches ? Parce qu’on leur fait confiance ! Ils ont de l’argent, certes, mais ils ont aussi prouvé qu’ils savaient faire. Est-il nécessaire d’avoir de l’argent pour inspirer la confiance ? Non !

Mais au fait, que signifie "investir" ? Voici ma définition : investir, c’est mobiliser une ressource sans garantie sur le résultat. En prenant le risque que cette "dépense" (d’énergie ou d’argent) puisse être perdue.

Mais en espérant que nos calculs, nos projections, notre anticipation de l’avenir seront justes et porteront leurs fruits !

Et si devenir riche se résumait finalement à un acte de foi ? Une école du lâcher prise dont nous avions tous le secret à la naissance : lorsque nous avons lâché la main qui nous sécurisait pour apprendre à marcher seul (e) !

Swagg Man ☛ Sa fortune ? ☉ Mon hypothèse ☉ by ♣ Maxime Lourenço ♣ Swagg Man révèle l'origine de sa fortune !!

De très gros sponsors dont il n'a pas le droit de dévoiler le nom???? Lol

Pour en savoir plus sur LE Swagg Man

Labels:

collection,

Comment devenir riche,

entrevue,

fortune,

francais,

France,

hip hop,

how to,

How to Get Rich,

montres,

NRJ,

origine,

radio,

rapper,

riche,

rolex,

Swagg Man

Sunday, June 7, 2015

How to Whoring Yourself to 80K a Year

Here below is an interesting point of view from the Wall Street Playboys about how any young man can get Money in his 20s by being a motherfuckin' wage-slave.

I've rebaptized it 'How to Whoring Yourself to 80K a Year'.

How to Invest as a Bachelor

Posted on January 31, 2014 by Wall Street Playboys

The most common question we receive nowadays is how to allocate cash if you’re going to live the bachelor lifestyle into eternity. This is going to be the first part in a series of posts where we will cover each step in more detail. However the three main steps are broken into two pieces: 1) The initial framework to financial independence, 2) Ways to obtain higher income and 3) Ways to swing for the fences when you’ve got extra money on the sideline.

1) The Framework

The name of the game is matching investment income to expenses. We’ll call this the relaxation point. If you’re correctly living your life as a minimalist we’ll earmark the number at $2,500 a month. Yes this is a low number but if you’re a perpetual bachelor it means that you can live quite a nice life in Thailand while you work on your other businesses and you will be free to work any job that you would like. We repeat,you are free to do as you please. How much is needed to generate $2,500 a month? Lets take a look and you can decide for yourself what amount of cash flow is necessary.

You’ve been tricked.

Look at the chart very carefully. Notice a major problem with a regular savings account? You have no chance at financial freedom with a savings account unless you have over $1.4 million in cold hard cash. If you’re trying to become rich and you are putting your money in a savings account you better be a risk taking entrepreneur because even a man of above average intelligence is going to have next to zero chance at amassing $1.4 million dollars in his thirties by having an investment return of 2%.

Lets make another assumption, lets say you understand that your body is going to slow down and you know you’re going to be half the man you were in your 30’s by the time you hit your late 50s. Not a PC comment and do not care. We are all going to get old so your goal is to maximize your happiness when you are able to enjoy it and at the same time set yourself up for a decent lifestyle in your 50s and 60s.

Assumptions are set. You’re in a race against time to obtain ~$450-550K in net worth, if you don’t have it by around thirty you better start grinding hard. For simplicity, we’ll use $500K as the watermark.

Obtaining $500K: Sounds like a lofty number doesn’t it? Not really. Long-term returns of 7% are not out of the question. The trick is that long-term means you’re ignoring your emotions by dollar cost averaging and you are not going to sell a single security or bond. Ride it out. Diversify, dollar cost average, diversify, dollar cost average. Play the game like a robot. Here’s how quickly you get to the five handle. We will assume that you are able to increase your income by ~5% on an annual basis, generate returns of 7% and you can live on $3K per month.

Boom. You’re already at $500K and you’re only 31 assuming that you choose your career wisely. Your first job out of college, out of trade school etc. will more likely than not determine your entire financial future.We already know the $53K net figure will be attacked however it shouldn’t. $53K a year net implies $80K per year gross.

You see the path and it takes 10 years of dedication to get there.

How to Earn $80K?

No doubt many people believe this number is too high. Lets flip it around. You know that a starting salary of $80K will give you an amazing shot at early financial freedom so lets start with how someone can obtain an $80K salary instead. No you won’t be working 40 hours a week and no there is no short cut to making a high income, you will pay a price: 1) mental effort, 2) endurance or 3) physical effort. If you do all three, well you’ll likely beat the 31 years of age mark by a country mile. Remember, you are young and you are in your twenties, the world is yours for the taking since you should be an energizer bunny at this stage in your life.

Mental Pain (require top tier schooling and grades)

High End Finance: Investment Banking, Private Equity, Sales and Trading, Equity Research, Hedge Funds.

High Consulting: Boston Consulting Group, Bain. McKinsey

Engineer: Google, Facebook, Twitter, Salesforce.com, lets go on and on and on with hundreds of tech companies. $80K out the gate

We know you’re saying “but what if I can’t get any of these jobs”, well how about this:

Endurance Pain (grinding out the hours)

Air Traffic Controller: Requires minimal education but is high stress

Accounting + Bartending: $50-55K a year + 2.5K a month on the side, you’re at 80K

Healthcare + Online Business: Trade schools are only 2 years long and can offer starting pay in the $50-60K range, you get a full 2 year head start and in addition… you can start a simply health website that will generate a few thousand dollars a month.

Now you’re saying these dual jobs are not practical or you cannot go into the top tier trades. Fair enough.

Physical Pain

Firefighters/Police Force: No risk no reward, will clear $80K. If you’re complaining about a few thousand dollars in difference we’ll simply respond that it won’t take you four years to get the job also… government pensions anyone?

Dockworkers: Manual work. Gruelling. Notice a trend in effort and income? $80K+ out the door

Now that your spirit is uplifted simply join one of these groups. There are hundreds of ways to make $80K a year. None of them are for the following people though 1) lazy, 2) uneducated or unwilling to do manual labor and 3) negative personality types. No matter what you do you’re going to have to put in that grind, it’s going to come from a mental standpoint (getting to a top tier college and top grades to go to Wall Street), physical standpoint (dock workers, firefighters) or from a longevity standpoint (working multiple occupations). Anyone reading this post can make $80K a year.

Final Note: Do not take a job for minimum wage no matter what. If you’re younger than 20 you can pick up a book and read how to fix iPhone screens and create a small time business fixing drunken mistakes in a major city. Do not work for minimum wage for anyone.

3) The Home Stretch

You’ve made it to $500K: Congratulations. If you run the rule of 72, when you hit 40 you will have $1M dollars in the bank. Welcome to the top 2% in the USA (there are roughly 5 million millionaires in the USA) and well into the 1% world wide. You’ve won the game and you’re just now hitting your stride as a man. Lets get cracking on some real wealth creation shall we?

That $5 handle is sitting on the sidelines and you won’t touch it. Close the book it is time to move on to bigger ideas. You’ve got 4-6 years left before you can really take the pedal off the gas if you feel like it. How do you capitalize? Well here are some interesting ideas to get you started.

Venture Capital/Private Investments: Now that you are saving ~$50K a year from your current job, no matter what track you took (we simplified it to 5% increases in salary), you can take some calculated risks. With the world becoming increasingly internet driven you can begin angel funding investments or purchasing shares in the private market. What does this mean? It means you’re swinging for the fences on a Mike Tyson level knock out punch. Generally speaking, most investment types will cause you to spend $25-100K to invest privately. That is fine because the goal is to take large equity swings with your annual savings since you don’t need more than $500K. You’re not searching for 5-7% returns anymore you’re trying to 10x or 20x your investment within the decade. No risk no reward it may go to zero.

Silent Investor: Use your additional cash to develop high level relationships. Similar to our post on politicshow do you gain trust with wealthy investors? Well you invest with them and don’t pester them with questions over a long time horizon, once someone likes you the doors open a bit wider. With that said, Private Equity comes to mind as a decent idea, not to be confused with private investments (separate entirely). You create an investment consortium. You buy in as part of the takeout group and you sit and wait and wait. You’re looking for an annual rate of return in the high 20’s.

Lever Up and Fix it: Properties can be dangerous but he who takes on the headache will take on the profits. This is last on the three major ways to take a 5 figure investment and double or triple it in short order due to the level of stress involved. The premise is as follows: buy a high risk property, the risk can be associated with lower income tenants to major headaches due to a short sale or foreclosure… Put down a down payment heavy enough to move your rate as close to 3% as possible (generally a down payment at 25-33% of purchase price will do the trick)… take out a 3 year ARM you’re betting on appreciation…. Roll up your sleeves, or hire someone else to do it, and fix the underlying property (commercial or residential). Sell it, gunning for a flip of 50% of purchase price.

Concluding Remarks: Over the coming weeks we are going to take a deeper look into each step starting with investing your first pay check. We’ll walk through scenarios where things may go wrong and scenarios where you can adjust your portfolio for the future. One thing is for certain though, if you don’t get on the investment train early, it won’t be stopping to pick you up any time soon.

Thursday, June 4, 2015

Al Capone business how to

Al Capone was taking in about $105,000,000 a year in revenues in the 1920's, or about 1.4 billion in today's dollars.

At 21 years old, he was an unknown bartender and bouncer. But by the age of 28, he was one of the richest and most powerful gangsters in the world. From these days, his name will forever synonymous with the word gangster.

It is estimated that by 1929, Al Capone's income from the various aspects of his business was $60,000,000 (illegal alcohol), $25,000,000 (gambling establishments), $10,000,000 (vice) and $10,000,000 from various other rackets. It is claimed that Capone was employing over 600 gangsters to protect this business from rival gangs.

Here is a very interesting text by Jeanette Mulvey, (BusinessNewsDaily Managing Editor)

Business Advice from Uncle Al ... (Capone, That Is)

Al Capone might not have been your typical entrepreneur. After all, he was convicted of tax evasion and was actively involved in prostitution, bribery, smuggling and selling illegal booze. But just because his business wasn't legal doesn't mean Capone didn't know a thing or two about running a successful operation. In fact, Capone owned more than 300 businesses and knew how to get things done and command respect and loyalty from his employees.

In fact, Capone's business acumen may well have been one of his greatest assets, according to Deirdre Marie Capone, Al Capone's grandniece who lived in the house of her famous (and favorite) uncle. Capone, the last member of the family born with the Capone name, authored an explicit memoir that details her efforts to hide the fact that she was related to Capone and recounts her decision to eventually embrace her name and family history.

The book, "Uncle Al Capone…The Untold Story From Inside His Family" (Recap Publishing, 2011), tells many never-before-known facts about this iconic figure's life, death and business dealings.

In the book, she recalls what life was like as a child growing up in the Capone household and shares fond memories of the man who taught her to ride a bike, swim and play the mandolin.

Capone said she knows what the "family" was really like, and what the "outfit" was all about. In her tell-all book, she shares details untold until now, including her claims that that Ralph (Al's older brother) and Al Capone lobbied the Nevada legislature to legalize gambling, alcohol and prostitution in that state; that they were the owners of the first upscale casino in Las Vegas way before Bugsy Siegel came to Vegas, and what really happened in the St. Valentine's Day Massacre.

In an exclusive interview with BusinessNewsDaily, Capone gives us some business tips that could have come directly from her notorious uncle.

In an exclusive interview with BusinessNewsDaily, Capone gives us some business tips that could have come directly from her notorious uncle.

- You're only as good as your word. Al Capone ran a very efficient business, she said. He taught every person who worked for him: "Your word should be your bond."

- Remember where you came from.When Al Capone saw one of his employees strut around acting like a big shot, he would tell him: "Don't let your head get too big for your hat."

- Be honest with your business partners. Ralph and Al Capone needed to give orders just once to the employees and they were expected to do their jobs correctly. Al Capone would instruct them, "Don't lie to the people you work for."

- Remember, it's never easy. Al Capone at one time ran more than 300 different establishments. When a reporter wrote about how easy it was for him to make money, he was quoted as saying. "Find out what it's like to run a business and meet a payroll."

- Earn your customers' loyalty. Al Capone supplied good quality alcohol to the citizens in Chicago from 1920 to 1931 during Prohibition. He was quoted by a reporter as saying "Be loyal to friends and invincible to enemies."

Source:

http://www.businessnewsdaily.com/2049-al-capone-business-advice.html

Here is another interesting text named Mob Movie Lessons: The Untouchables published by Mr. Mafioso on Askmen.com

A kind word and a gun

In The Untouchables, Capone says: “You can get more with a kind word and a gun than you can with just a kind word alone.” This statement is the foundation of Capone’s kingdom. He ran Chicago and he took over the bootlegging racket because he was feared. I’m not saying violence is the answer, but what I am saying is that a Mafioso is feared. In the movie, Capone blows up a bar that wouldn’t buy his beer. What do you think the next bar owner is going to do? He’s going to buy Capone’s beer because he fears him. You don’t need to blow anything up, but people gotta understand that you mean business.

Bribe if need be

Another trademark of Alphonse Capone that was shown in The Untouchables was his success in bribing city officials. He knew where and when Eliot Ness was going to organize a raid because half the city’s police force was on his payroll. His men had permits to carry concealed weapons signed by the mayor. Why? Because the mayor was on his payroll. When he goes to court, the jury is paid off and the judge is paid off. Capone made sure that the city officials ran the city the way he wanted them to. He knew that whatever money was spent in bribing officials was a good investment. He was a master at bribing people, and Capone showed that bribery can go a long way.

Get the right people

After his first alcohol raid failed miserably, Eliot Ness realized he had the wrong people. His answer came from the Irish beat cop Malone (Sean Connery) who said: “If you don’t want rotten apples, don’t get them from the barrel — get them from the tree.” Ness couldn’t work with the Chicago police force because most of the force, including the chief of police, were being paid off by Capone. Instead, Ness and Capone go to the Police Academy to recruit "greenies" who hadn’t been corrupted yet. His crew was small, but Ness had the right people on board.

Cover all your tracks

Capone was good about keeping himself out of trouble; he covered his tracks well, but he didn’t cover all of his tracks. He hadn’t paid an income tax in years. In fact, Capone showed no income at all on his tax documents. It was this discovery that eventually brought him down on income tax evasion charges. Had he only showed a small income, had he but paid a small amount of taxes, the story of Al Capone might have ended much differently. He might have been around much longer and grown his empire much larger. That’s why you gotta cover all your tracks; you could go down because of the smallest thing. You can never be too thorough when covering your tracks.

stronzo scene

Alphonse Capone’s first big mistake was to publicly show off what he had accomplished. Instead of laying low and enjoying his position at the top of the Chicago food chain, Capone spoke to reporters constantly. He made sure everyone knew just how successful he was. He owned and lived in the Lexington Hotel. Everything he did was eccentric and extravagant. That was all well and good in Chicago, where he had even the Mayor on his payroll, but once the federal government took notice, his demise began. Run your rackets and keep your head low. Don’t make yourself a celebrity and your operation will last a lot longer, capisce?

Source: http://ca.askmen.com/money/mafioso_200/221_mob-movie-lessons-ithe-untouchablesi.html

http://www.businessnewsdaily.com/2049-al-capone-business-advice.html

http://spartacus-educational.com/USAcapone.htm

http://ca.askmen.com/money/mafioso_200/221b_mob-movie-lessons-ithe-untouchablesi.html

Subscribe to:

Posts (Atom)