Motivation, inspiration, information... Get-rich-quick because life is too short to get rich slow.

Friday, October 26, 2018

DO WHAT YOU CAN'T

This summary is not available. Please

click here to view the post.

Labels:

famous,

internet celebrity,

kick ass,

motivation,

vlog,

vlogger

Saturday, September 22, 2018

Wednesday, September 19, 2018

Friday, August 31, 2018

Lead, Follow or Get Out Of The Way

Either Lead, Follow or Get Out Of The Way as seen on Billionaire Ted Turner Atlanta office. The phrase “lead, follow or get out of the way” has been used by many famous people such as General George S. Patton, former Chrysler executive Lee Iacocca, former presidential candidate Mitt Romney and Ted Turner himself.

Now you can wear this empowerment shirt!

Labels:

Billionaire Ted,

business,

clothes,

Lead Follow or Get Out Of The Way,

media,

mogul,

quote,

shirt,

T-shirt,

Ted Turner,

wisdom

Thursday, August 30, 2018

Online Gambling: Profitable Tricks for Gaining an Edge

When it comes to getting rich quick, it's hard to top the prospect of gambling your way to baller status. This path to paradise is often instead a road to disaster, however, as most bettors with dreams of scoring a fortune from the house are undisciplined, ill-informed and driven by emotion. Rather than improving their financial position, they basically donate their cash to line the pockets of gaming hall owners.

There are ways to tilt the odds in your favor whether you prefer poker, casino games, sports betting, or some other form of wagering. In order to do so, you need to take advantage of every edge available. Fortunately, there are plenty of ways to enhance your chances of booking sizable wins by claiming every benefit from the gaming operators to which you're entitled. Of course, you'll need to be familiar with all the strategies and techniques of proper play too, but the addition of lucrative extras on top of what you collect through straight gambling is indispensible if your aim is to become a true professional gambler.

Keep your eyes open for the following special deals depending on what types of wagering you intend to conduct:

1. Online Poker

Rake races, free tournament entries and mission challenges all have their place in building the bankrolls of aspiring card sharks. However, there's one type of perk that stands head-and-shoulders above all others if you plan on putting in some serious volume at the poker tables: rakeback. Unlike the other promos mentioned above, rakeback is always active, delivering back to you a steady portion of the rake and tournament fees you pay to the poker room.

Rake is how the operators make money, extracting a portion of each pot for themselves. Just like other businesses do, they refund some value back to their frequent and valuable clients. Unlike credit card reward programs or bulk merchandise discounts, though, the percentage of cashback on offer with a good RB deal often exceeds 20%, 30%, 40% or even 50% of the money you pay!

There are any number of internet poker sites that offer rakeback. If rakeback is present at the room you play at but you neglect to take advantage of it, then you're needlessly leaving money on the table.

2. Online Sports Betting

Betting on sports is a time-honored way of securing an income. Just look at Las Vegas-based sports betting king Bill Walters and his reported $100 million net worth to see how profitable this activity can be. It's now even easier to get started in this field due to the proliferation of online sportsbooks.

Of course, you still need to make your picks carefully. You'll want to read up on the latest information and statistics on the matches and players you're going to put money on. Yet, even after conducting all your research on the athletes and teams involved, there's still more to take into account.

You see, each bookie charges a vigorish (“vig” or “juice”), meaning that the odds are shaded a bit from what the bookmaker thinks the true odds are so that the establishment can make money. However, there are frequent reduced juice specials running from time to time, and it behooves you to capitalize on them whenever possible. The less the house takes for itself, the more there is to distribute to winning bettors: a category to which you will hopefully belong. A few internet bookmakers have even earned themselves a reputation for everyday low juice, and it may be in your best interest to make one of these your sports betting home.

3. Online Casinos

It's true that the house always has an advantage in casino games (barring the rare progressive slots jackpot or full-pay video poker machine). Yet, this edge is sometimes miniscule, as it is in blackjack, and you can frequently more than offset the house advantage by claiming promotional offers and using a little bit of common sense.

You may sometimes encounter free casino bets, matched bets and loss-back promos. Each of these forms of complimentary cash adjusts the mathematics of the games in question so that, in many cases, you can gain a positive expectation. Now, there's a lot of variance to these betting opportunities, so you can do everything right and still lose. But by shifting the numbers in your favor, you stand an excellent chance of setting yourself up for enviable results in the long run.

4. Brick-and-Mortar Casinos

We've focused on virtual gaming facilities so far because they're the most convenient for our readers, but plenty of pro gamblers have made their bones in live casino settings. Apart from spotting and exploiting errors in dealing and other subtle casino mistakes, perhaps the most important thing you can do is make sure all your play is tracked.

Casino reward cards exist so that these establishments can treat their VIPs right, but they only work if the customer actually participates. When you sit down at a casino table game, like baccarat, always make sure you present your club card to the dealer. When plowing through the rounds on a slot machine or video poker terminal, don't forget to insert your card into the channel provided for this purpose. In games with a low house edge, the value of the comps you collect can often exceed the casino's expected take from your play.

|

| You can't earn comps without a rewards card, fool! |

“Queen of Comps” Jean Scott is well aware of this element of casino play. Over the years, this retired schoolteacher has parlayed her knowledge of correct video poker strategy and the intricacies of casino reward systems to pick up free vacations, top-shelf liquor and food, tickets to popular events and more. You too can achieve similar levels of rewards – but only if you remember to have your bets tracked through your player card!

It is possible to make a living – and a pretty decent one too – by gambling. But you have to ask yourself what kind of bettor you are. Are you one of the millions of chumps who trust in luck and/or prayer to swim against the current and become one of the handful of substantial winners? Or are you someone who engages your intelligence, patience and emotional fortitude to steadily accumulate earnings while always attempting to use every legal means at your disposal to turn the tables on the house? If you're a member of this latter group, then the tactics we've outlined above will undoubtedly help you in attaining your goals.

Labels:

“Queen of Comps” Jean Scott,

bettors,

Bill Walters,

brick-and-mortar casinos,

comps,

gambling,

get rich quick,

make a living by gambling,

online casinos,

online poker,

online sports betting

Monday, August 6, 2018

All The MONEY In The WORLD!!!

Thursday, July 19, 2018

Sunday, July 15, 2018

Ted Turner Atlanta office

|

| Framed magazine covers adorn a wall in Ted Turner's Atlanta office. |

|

| A trophy case in Ted Turner's office holds awards marking many of his achievements |

EITHER LEAD, FOLLOW OR GET OUT OF THE WAY

http://www.cnn.com/2013/11/17/us/ted-turner-profile/

https://www.pygear.com/2018/08/lead-follow-or-get-out-of-the-way.html

https://shop.spreadshirt.com/pygod/either+lead+follow+or+get+out+of+the+way-A110468473

Labels:

Atlanta,

billionaire,

Billionaire Ted,

CNN,

front pages,

media mogul,

office,

philanthropist,

Ted Turner,

trophy case,

WCW

Monday, June 4, 2018

Magnus Carlsen chess Elo evolution

|

| Magnus Carlsen chess Elo constant evolution. BillionaireGambler.com |

Source: https://www.quora.com/How-can-I-beat-Carlsen-in-chess

Friday, May 11, 2018

Game Over: Kasparov and the Machine 2003

First match

- February 10, 1996: takes place in Philadelphia,Pennsylvania

- Result: Kasparov–Deep Blue (4–2)

- Record set: First computer program to defeat a world champion in a classical game under tournament regulations

Second match (rematch)

- May 11, 1997: held in New York City, New York

- Result: Deep Blue–Kasparov (3½–2½)

- Record set: First computer program to defeat a world champion in a match under tournament regulations

Peak Elo chess rating: 2851

IQ: 190

Garry Kasparov is the greatest chess player of all time.

Nowadays computers are far stronger than human chess GrandMasters.

Current chess world champion Magnus Carlsen is rated 2877.

Computer program Stockfish is rated 3290.

Artificial Intelligence program Alpha Zero destroyed Stockfish 28 wins, 72 draws, and zero losses in a 100-Game Match.

AlphaZero must be rated 3500.

Related links:

https://en.wikipedia.org/wiki/Garry_Kasparov

https://en.wikipedia.org/wiki/Comparison_of_top_chess_players_throughout_history

https://en.wikipedia.org/wiki/Deep_Blue_versus_Garry_Kasparov

https://en.wikipedia.org/wiki/Game_Over:_Kasparov_and_the_Machine

https://www.chess.com/forum/view/general/the-10-most-important-moments-in-chess-history-chess-home-page2

https://www.chess.com/news/view/google-s-alphazero-destroys-stockfish-in-100-game-match

https://en.wikipedia.org/wiki/AlphaZero

https://en.wikipedia.org/wiki/Stockfish_(chess)

https://en.wikipedia.org/wiki/The_Turk

https://www.chess.com/article/view/the-5-most-dangerous-chess-players-ever

Wednesday, April 4, 2018

Sunday, March 18, 2018

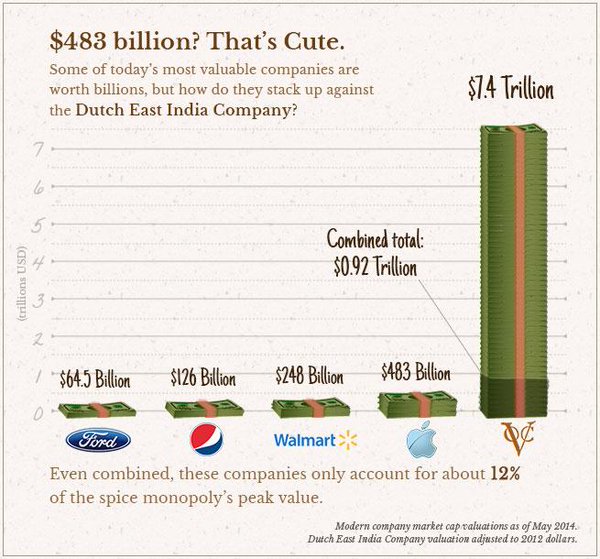

Dutch East India Company vs. Apple

Chart: The Most Valuable Companies of All-Time

MODERN JUGGERNAUTS LIKE APPLE DON’T EVEN COME CLOSE

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Before speculative bubbles could form around Dotcom companies (late-1990s) or housing prices (mid-2000s), some of the first financial bubbles formed from the prospect of trading with faraway lands.

Looking back, it’s pretty easy to see why.

Companies like the Dutch East India Company (known in Dutch as the VOC, or Verenigde Oost-Indische Compagnie) were granted monopolies on trade, and they engaged in daring voyages to mysterious and foreign places. They could acquire exotic goods, establish colonies, create military forces, and even initiate wars or conflicts around the world.

Of course, the very nature of these risky ventures made getting any accurate indication of intrinsic value nearly impossible, which meant there were no real benchmarks for what companies like thisshould be worth.

SPECULATIVE PEAK

The Dutch East India Company was established as a charter company in 1602, when it was granted a 21-year monopoly by the Dutch government for the spice trade in Asia. The company would eventually send over one million voyagers to Asia, which is more than the rest of Europe combined.

However, despite its 200-year run as Europe’s foremost trading juggernaut – the speculative peak of the company’s prospects coincided with Tulip Mania in Holland in 1637.

Widely considered the world’s first financial bubble, the history of Tulip Mania is a fantastic story in itself. During this frothy time, the Dutch East India Company was worth 78 million Dutch guilders, which translates to a whopping $7.9 trillion in modern dollars.

This is according to sources such as Alex Planes from The Motley Fool, who has conductedextensive research on the history of very large companies in history.

MODERN COMPARISONS

The peak value of the Dutch East India Company was so high, that it puts modern economies to shame.

In fact, at its height, the Dutch East India Company was worth roughly the same amount as the GDPs of modern-day Japan ($4.8T) and Germany ($3.4T) added together.

Even further, in today’s chart, we added the market caps of 20 of the world’s largest companies, such as Apple, Microsoft, Amazon, ExxonMobil, Berkshire Hathaway, Tencent, and Wells Fargo. All of them combined gets us to $7.9 trillion.

At the same time, the world’s most valuable company (Apple) only makes it to 11% of the peak value of the Dutch East India Company by itself.

HISTORIC HEAVYWEIGHTS

Despite the speculation that fueled the run-up of Dutch East India Company shares, the company was still successful in real terms. At one point, it even had 70,000 employees – a massive accomplishment for a company born over 400 years ago.

The same thing can’t be said for the other two most valuable companies in history – both of which were the subject of simultaneous bubbles occurring in France and Britain that popped in 1720.

In France, the wealth of Louisiana was exaggerated in a marketing scheme for the newly formed Mississippi Company, and its value temporarily soared to the equivalent of $6.5 trillion today. Meanwhile, a joint-stock company in Britain, known as the South Sea Company, was granted a monopoly to trade with South America. It was eventually worth $4.3 trillion in modern currency.

Interestingly, both would barely engage in any actual trade with the Americas.

The other historic heavyweights included in our chart?

- Saudi Aramco, at $4.1 trillion, based on calculations by University of Texas finance professor Sheridan Titman in 2010, and adjusted for inflation.

- PetroChina surpassed $1 trillion in market cap in 2007. Adjusted for inflation that’s $1.4 trillion today.

- Standard Oil, before its famous breakup due to monopolistic reasons, was worth at least $1 trillion. Adjusted for inflation it would likely be more, but we kept this conservative.

- Microsoft reached its peak valuation in 1999, at the top of the Dotcom Bubble. Today, that would be equal to $912 billion.

Original link of the post: http://www.visualcapitalist.com/most-valuable-companies-all-time/

Wednesday, March 14, 2018

Jeff Bezos the first official CentiBillionaire & Amazon 14 Principles of Success

|

| Jeff Bezos the first official CentiBillionaire |

As you may know Amazon Jeff Bezos officially became the first Centi-Billionaire with a $130.5 Billion net worth.

Right now, Jeff Bezos is making $231,000 a minute, $10 Billion a month.

http://time.com/money/5192998/jeff-bezos-net-worth-2018-worlds-richest-man/

As mentioned on Wikipedia,

- On July 27, 2017, Jeff Bezos briefly became the world's wealthiest person when he accumulated an estimated net worth of just over $90 Billion.

- On November 24, 2017, Jeff Bezos' wealth surpassed $100 Billion for the first time after Amazon's share price increased by more than 2.5%.

- On March 6, 2018, Jeff Bezos was formally designated the wealthiest person in the world with a registered net worth of $112 Billion by Forbes, becoming the first Centi-Billionaire.

- As of March 14, 2018, Jeff Bezos has an estimated net worth of $130.5 Billion, and is contended to be on track to become the wealthiest person in contemporary history.

Source: https://en.wikipedia.org/wiki/Jeff_Bezos

Here below are the 14 Principles of Amazon.com taken directly from the Amazon website.

Read attentively since these 14 Principles are a Blueprint to $ucce$$.

Our Leadership Principles aren't just a pretty inspirational wall hanging. These Principles work hard, just like we do. Amazonians use them, every day, whether they're discussing ideas for new projects, deciding on the best solution for a customer's problem, or interviewing candidates. It's just one of the things that makes Amazon peculiar.

Leaders start with the customer and work backwards. They work vigorously to earn and keep customer trust. Although leaders pay attention to competitors, they obsess over customers.

Leaders are owners. They think long term and don't sacrifice long-term value for short-term results. They act on behalf of the entire company, beyond just their own team. They never say "that's not my job."

Leaders expect and require innovation and invention from their teams and always find ways to simplify. They are externally aware, look for new ideas from everywhere, and are not limited by "not invented here." As we do new things, we accept that we may be misunderstood for long periods of time.

Leaders are right a lot. They have strong business judgment and good instincts. They seek diverse perspectives and work to disconfirm their beliefs.

Leaders raise the performance bar with every hire and promotion. They recognize exceptional talent, and willingly move them throughout the organization. Leaders develop leaders and take seriously their role in coaching others. We work on behalf of our people to invent mechanisms for development like Career Choice.

Leaders have relentlessly high standards—many people may think these standards are unreasonably high. Leaders are continually raising the bar and driving their teams to deliver high-quality products, services, and processes. Leaders ensure that defects do not get sent down the line and that problems are fixed so they stay fixed.

Thinking small is a self-fulfilling prophecy. Leaders create and communicate a bold direction that inspires results. They think differently and look around corners for ways to serve customers.

Speed matters in business. Many decisions and actions are reversible and do not need extensive study. We value calculated risk taking.

Accomplish more with less. Constraints breed resourcefulness, self-sufficiency and invention. There are no extra points for growing headcount, budget size, or fixed expense.

Leaders are never done learning and always seek to improve themselves. They are curious about new possibilities and act to explore them.

Leaders listen attentively, speak candidly, and treat others respectfully. They are vocally self-critical, even when doing so is awkward or embarrassing. Leaders do not believe their or their team’s body odor smells of perfume. They benchmark themselves and their teams against the best.

Leaders operate at all levels, stay connected to the details, audit frequently, and are skeptical when metrics and anecdote differ. No task is beneath them.

Leaders are obligated to respectfully challenge decisions when they disagree, even when doing so is uncomfortable or exhausting. Leaders have conviction and are tenacious. They do not compromise for the sake of social cohesion. Once a decision is determined, they commit wholly.

Leaders focus on the key inputs for their business and deliver them with the right quality and in a timely fashion. Despite setbacks, they rise to the occasion and never settle.

Customer obsession may be the most important of this bunch. In practice, it translates, as Bezos noted in a recent conference appearance, to three elements:

- low prices,

- convenient shipping,

- and unlimited selection.

Other interesting sources:

Labels:

Amazon,

Amazon 14 Principles,

Amazon.com,

business,

Centi-Billionaire,

CentiBillionaire,

finance,

Forbes,

fortune,

Jeff Bezos net worth,

leadership,

secrets of success,

world's richest,

world's wealthiest person

Monday, March 5, 2018

ADAPT or DIE - Charles Darwin, management consultant

“One general law, leading to the advancement of all organic beings, namely, multiply, vary, let the strongest live and the weakest die.” –Charles Darwin

“It is not the strongest or the most intelligent who will survive but those who can best manage change.” –Charles Darwin

“I think it inevitably follows, that as new species in the course of time are formed through natural selection, others will become rarer and rarer, and finally extinct. The forms which stand in closest competition with those undergoing modification and improvement will naturally suffer most.”–Charles Darwin

“It is always advisable to perceive clearly our ignorance.”—Charles Darwin

“In the long history of humankind (and animal kind, too) those who learned to collaborate and improvise most effectively have prevailed.”—Charles Darwin

“We are always slow in admitting any great change of which we do not see the intermediate steps”—Charles Darwin

Charles Darwin, management consultant

For more informations: https://venturevalkyrie.com/deaths-of-the-unfit-outnumber-survival-of-the-fittest/

Wednesday, February 14, 2018

The Richest Family in the World

The Richest Family in the World

Who was the wealthiest person in every century? That was a question we tried to answer in a previous TIFO article. While it was an incredibly difficult question to get definitive answers to, it did reveal that the wealthiest private entity in the 19th century was actually not a person – but a family. The Rothschild family, descendants of Mayer A. Rothschild, is still around today and is believed to be worth over a trillion dollars combined, thought to be the largest private fortunate in the history of the world. Who are the Rothschilds exactly and how did they amass this tremendous fortune?

$$$$$PYGOD.COM$$$$$

Wednesday, January 24, 2018

Tuesday, January 16, 2018

World's Stupidest Lottery Winner

At the question "Who was the most stupidest lottery winner?" I've found the right answer on Quora.com written by Barigye Riddick, B.A Law, Uganda Christian University (2018)

Answered January 1 2018

Meet Andrew Jackson "Jack" Whittaker, Jr.

Quick Bio:

- Age; 70 years old

- Jackpot won; $315 million Powerball jackpot(Single Ticket) in Dec. 2002

- Occupation before winning; President of Diversified Enterprises Construction worth $17 million.

- Payout; Chose the cash option of $113,386,407, after taxes

Two facts are established;

- He was millionaire before.

- He was extremely lucky.

So what went wrong, you ask?

For starters, he pledged 10% of his winnings to Christian charities—including several churches affiliated with the Church of God—in southern West Virginia.

That 10% was an equivalent of $ 11,338,640. Damn!

He also donated $14 million to establish the Jack Whittaker Foundation, a non-profit organization that provides food and clothing to low-income families in rural West Virginia.

Moreover, for the deli manager who served the biscuits at the convenience store where he purchased the winning ticket, he purchased a $123,000 house and a new Jeep Grand Cherokee and gave her a check for $44,000.

Who is this guy? An Angel! (Just Kidding.) He’s kind at heart and honestly beyond generous. That doesn’t make him stupid…right?

But check this out;

Whittaker spent money at strip clubs and casinos.

We all have our demons, well this was his. Coupled with heavy drinking and a bad habit for carrying cash in his car.

Thieves stole $545,000 from his car in a West Virginia strip club parking lot while he was inside in Aug, 2003.

We all learn from our mistakes, right? Jack did not.

Thieves once again broke into his car, stealing an estimated $200,000 in cash that was later recovered in Jan, 2004.

I mean come on “Jack” WTF!

When asked why he would carry that much money around with him, Whittaker responded "because I can".

What a dummy? Do you sense the Pride? It had consumed his heart.

2004- till present.

A string of personal tragedies followed.

In Sept. 2004, his granddaughter’s boyfriend was found dead from a drug overdose in Whittaker’s home.

Three months later, the granddaughter also died of a drug overdose; “I wish I’d torn that ticket up,” he sobbed to reporters at the time of his daughter’s death.

May her soul rest in peace.

Her mother, Ginger Whittaker Bragg, died five years later on July 5, 2009.

He’s was also sued by Caesars Atlantic City casino for bouncing $1.5 millionworth of checks to cover gambling losses.

In Dec. 2016 Whittaker's home caught fire. When firefighters arrived, the home was fully engulfed. Whittaker stated that the home was not insured.

To Sum it up.

Some may say a lot of tradegy befell him, I totally agree but he fucked up.

- He spent his money at strip clubs and casinos yet he would have invested in a passive income business like Real estate, Oil and Gas, Education. etc

- He negligently left money in his car and got robbed twice.

- He had a gambling addiction; I mean look at it this way, he had beat staggering odds of 292 million and walked away with a huge prize, why risk it again?

- He showered gifts and cash on his beloved 16-year-old granddaughter, who spent much of the money on drugs. This could have been avoided by controlling her finances.

- He was kinda too generous. Did you know that one of the beneficiary congregations constructed a multi-million-dollar church in Hurricane?

If that’s not stupid, then bite me.

Full Bio; Here[1]

Footnotes

Sources: https://www.quora.com/Who-was-the-most-stupidest-lottery-winner

https://en.wikipedia.org/wiki/Jack_Whittaker_(lottery_winner)

Labels:

bad luck,

dumb,

Jack Whittaker,

lottery,

lottery winner,

lucky,

stupid,

worst

Subscribe to:

Posts (Atom)